Segment composition ratio

- [Notes]

-

- *1The components of revenue represent sales to external customers.

- *2Operating income of the Distribution segment for FY2024 is ¥30.4 billion.

- *3Operating income of the Financial segment for FY2024 is ¥33.2 billion.

- *1

Business strategy

By offering price plans and services tailored to user needs, we aim to expand our smartphone subscriber base, lift average revenue per user (ARPU), and maximize mobile revenue.

Three competitive advantages

1. Multi-brand strategy

The Company provides three distinct brands: ‘SoftBank,’ which offers unlimited-data plans; ‘Y!mobile,’ featuring lower monthly charges for low to medium volume data users; and ‘LINEMO,’ an online exclusive brand that lets customers complete all procedures and receive support entirely online. By matching price plans to evolving user needs, the Company aims to expand acquisitions of new subscriptions, prevent users from moving outside the Group, and increase ARPU.

2. Synergy with leading services offered by group companies

The Group operates some of Japan's largest digital platforms, including ‘LINE,’ a communication app, ‘Yahoo! JAPAN,’ a comprehensive Internet service, and ‘PayPay,’ a cashless payment service. By combining these with our mobile communication service, we deliver unique added value. ‘SoftBank’ and ‘Y!mobile’ users can enjoy ‘LYP Premium’ —which provides numerous benefits from ‘LINE’ and ‘Yahoo! JAPAN’— at no extra charge. In October 2023 we also launched the ‘PayToku’ plan, which boosts PayPay Point rewards on PayPay purchases. Leveraging these synergies differentiates us from competitors and drives growth by deepening engagement across the Group's ecosystem.

3. High-quality communications networks

Commercial 5G service, introduced in March 2020, now covers more than 95% of Japan's population and continues to expand. To date we have delivered ultra-high-speed, large-capacity connections mainly via non-standalone (NSA) 5G. We are now progressively upgrading to standalone (SA) 5G, which will add ultra-low latency and massive-device connectivity, enabling next-generation services that fully exploit 5G's capabilities.

Business target

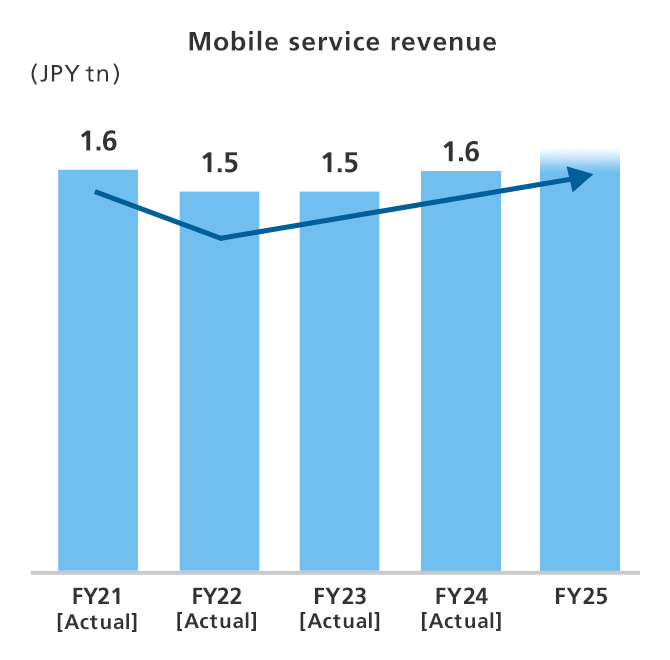

| Mobile service revenue |

To hit bottom in FY2023 and return to growth (Progress in FY2024) |

|---|---|

| Segment income |

To hit bottom in FY2022 and return to growth (Progress in FY2024) |

- [Note]

-

- *From the first quarter of FY2024, certain subsidiaries that were previously classified under the Consumer segment have been transferred to Other. As a result, the figures for FY2023 have been retrospectively adjusted

- *